Brentin Mock

Brentin Mock is a staff writer at CityLab. He was previously the justice editor at Grist.

(Comment 1/8) There are three important misunderstandings of our work in the article below:

• The initial conditions we talk about in our model do not represent the entire or final effects of historical events on African Americans.

• We use the word "snapshot" in reference to statistical techniques that characterize data from one point in time, not in reference to the history of abuses against African Americans that generated the racial wealth gap.

• Our results call for directing attention back to the role of the labor income gap in perpetuating wealth inequality.

We are not saying that policy should focus on reducing the labor income gap to the exclusion of all else.

For example, we think that it's important to continue to focus on policies that aim to eliminate racial barriers to wealth accumulation.

We provide specific details below.

-Daniel and Dionissi

(Comment 2/8)

Our analysis does not separate historic factors from income inequality,

and in no way do we interpret our results as indicating that historic factors are unimportant for the present-day racial wealth gap.

To be clear: We think the current wealth gap is a result of the centuries of violence and robbery that created the wealth gap, as well as the processes these actions set in motion that continue today.

-Daniel and Dionissi

If the college cheating scandal has reinforced anything, it’s that one of the primary advantages of being wealthy is that the wealthy can buy more advantages. This helps explain why African Americans, who’ve historically been denied wealth, lag in almost every category of society behind whites, who have long benefited from capital extracted from black labor and culture. It also helps explain why—despite a “booming” U.S. economy that is nearing full employment—a gigantic racial wealth gap remains. On average, white households have nearly 6.5 times the wealth of black households.

That gap can be ameliorated, though, by closing the earnings gulf between black and white workers, according to new research from two economists at the Federal Reserve Bank of Cleveland. In a commentary recently published on the Cleveland Fed website, economists Dionissi Aliprantis and Daniel Carroll argue that racial differences in income drive the wealth gap more than any other factor, including differences in financial savings practices, rates of return on investments, or even intergenerational transfers of wealth.

This runs counter to loads of scholarship pointing to a different explanation of black-white wealth disparities in the U.S.: That narrative holds that white wealth accumulated from the trading and enslavement of Africans, and from the taking of black-owned property was passed down to white children and grandchildren. Government policies such as racial housing covenants, redlining, financial handouts for white war veterans, and highway expansions provided additional wealth expansion for white families while providing net-zero wealth opportunities for African Americans. Aliprantis and Carroll acknowledge this narrative as the initial conditions for how wealth began developing across divergent black and white paths.

But it only explains “snapshot(s) in time,” reads their commentary.

(Comment 3/8)

Our Commentary does not interpret the narrative above in terms of "snapshot(s) in time."

What our Commentary says is that statistical techniques looking at data from one year "tend to represent a snapshot at one point in time."

Our work does not run counter to the narrative that black-white wealth disparities in the US are the result of the awful history described above.

In fact, our work helps to bring that narrative back into the conversation about the racial wealth gap.

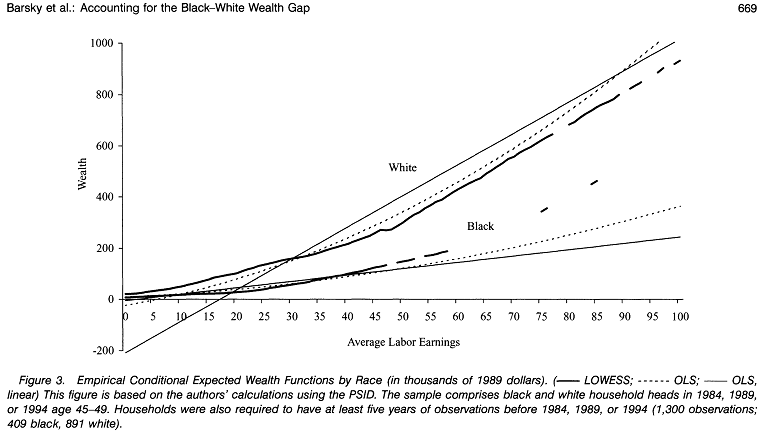

Specifically, consider Figure 3 from Barsky et al. (2002).

What explains the gap between the expected wealth of blacks and whites for a given income level?

The gap in the figure above is the "puzzle" we set out to address in our research.

Most of the academic literature has attempted to explain this gap in wealth between blacks and whites in terms of contemporaneous characteristics such as educational attainment. Our approach is different. We ask: Given the history described above, combined with the fact that wealth takes time to build up, shouldn't we expect large differences in wealth between black and white households to remain today?

The gap in the figure above is the "puzzle" we set out to address in our research.

Most of the academic literature has attempted to explain this gap in wealth between blacks and whites in terms of contemporaneous characteristics such as educational attainment. Our approach is different. We ask: Given the history described above, combined with the fact that wealth takes time to build up, shouldn't we expect large differences in wealth between black and white households to remain today?

Answering this question is the starting point of our analysis.

We set up our model with the differences in wealth actually observed in 1962 (the first year for which reliable wealth data is available),

and suppose that income and inheritances follow paths over time like those observed in the data.

We find that the historical view is in fact a useful one:

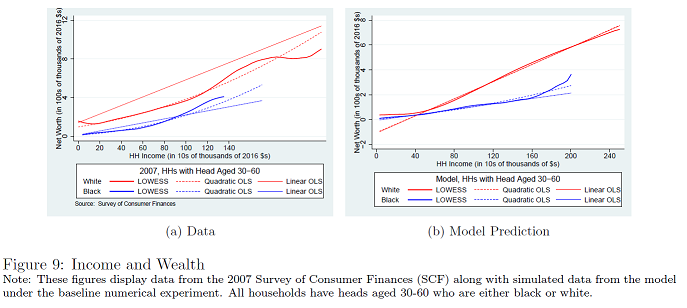

Our model makes predictions about the relationships between income, wealth, and race that are similar to what we observe in the data.

As shown below, our model actually predicts the current racial wealth gap - the "puzzle" just discussed.

We want to be clear about the ways that historic factors enter the analysis here.

Historic factors are a part of each of the principal mechanisms we study in our analysis.

We consider and allow for racial inequality in initial conditions,

returns on capital,

inheritances, and

labor income.

To start, there is the history of centuries of violence and robbery that led to the racial wealth gap in 1962, just prior to the passage of civil rights legislation

(as noted above, 1962 is the year in which we start our analysis because it is the first year in which we have reliable wealth data).

The wealth gap at this point in time, by itself, is what we refer to in our analysis as initial conditions.

Unequal returns on capital represent an important mechanism to include

because of the history of redlining and the continued segregation of US cities, along with the role of homeownership in building wealth in the US.

Our model also allows for unequal inheritances, or the intergenerational transfer of wealth.

This is an important mechanism to include because the initial wealth gap from 1962 was so large that one might imagine it being self-sustaining even if all other factors were equalized.

Finally, there is labor income.

Our model includes a racial income gap, but we make no claims about what generates that gap.

The racial income gap could be generated by any combination of:

continued discrimination in the labor market,

neighborhood sorting and externalities as we studied

in an earlier paper

and as originally discussed in

Wilson (1987),

a skill gap

maintained by the related issue of

continued school segregation,

changes in the return to

cognitive

or

non-cognitive/social

skills over time,

incarceration policies,

the role of wealth in facilitating a college education

(related theoretical and

empirical studies),

household formation,

housing instability,

differences in mortality rates (which appear even at young ages as documented here and here),

correlated income shocks through the obligation to support one's family,

etc.

When we write that the labor income gap is the largest factor maintaining the racial wealth gap,

we are in no way claiming that the processes generating the labor income gap are not affected by historic factors.

Perhaps this claim could be inferred if one were to (incorrectly) interpret initial conditions as representing all historic factors in our analysis.

This claim might also be inferred because we have intentionally stayed agnostic about what generates the income gap.

The reason we have not more directly addressed the labor income gap is because

even if we incorporated one or two of the factors listed in the paragraph above into our model

(which would already be very difficult with this kind of model),

it would feel like we were limiting the discussion by ignoring a group of other very important factors.

-Daniel and Dionissi

For their current study, they examined the “dynamic nature of wealth accumulation” over time. Using these dynamics, they argue that starting in the 1960s, the initial conditions that birthed the black-white gap—slavery, redlining, etc.—began diminishing as the drivers of the wealth disparity.

(Comment 4/8) Thinking of our analysis as treating "initial conditions" and "historic factors" as being interchangeable is likely to be a source of misunderstanding.

-Daniel and Dionissi

Reads their commentary:

What do we mean when we say that the labor income gap can account for the racial wealth gap? First, our model predicts that income and wealth will have a relationship in the future like the one we observe today. Our model predicts that, starting from 1962, it would take 259 years for the ratio of black and white mean wealth to reach 0.90.

Second, changing the labor income gap in the model changes the wealth gap dramatically. For example, when we remove the labor income gap in our model, meaning black and white households immediately earn the same income from their labor from 1962 onward, the black-to-white wealth ratio reaches 90 percent by 2007.

Third, other factors we might have suspected as playing major roles in maintaining the racial wealth gap pale in comparison to the role of the labor income gap. For example, when our model makes predictions under a gap in returns to investment as large as the gap in labor income, we find little change. The same is true for equalizing the inheritance process.

In other words, while all those initial conditions—from slavery to passing down slavery’s profits—may have created the wealth gap, it’s unequal income that has kept that gap alive from 1962 until today.

According to Aliprantis, focusing solely on the initial conditions of the racial wealth gap leaves unresolved a “puzzle” about the relationship between income and wealth: African Americans earned more and accumulated more wealth in the years since 1962 than ever before in history. But the black-white wealth gap has barely budged.

(Comment 5/8) Again, thinking of our analysis as treating "initial conditions" and "historic factors" as being interchangeable is likely to be a source of misunderstanding.

Also worth reiterating from Comment 3 is that the "puzzle" we set out to address in this research

is not generated by focusing solely on initial conditions, but rather by not sufficiently taking initial conditions into account.

-Daniel and Dionissi

“When we started working on this research, the puzzle around income and wealth suggested to us very strongly that we should focus on dynamics, [meaning] changes over time,” said Aliprantis. “So the question we pose is: Assuming black and white households are the same, except that black households start out with way less wealth and have lower incomes, what kind of relationship would we expect to observe between income and wealth by race? Is it consistent with what we see in the data?”

(Comment 6/8) Note: Here "the same" means identical in terms of preferences over consumption, leisure, and time, so that our analysis does not consider these types of differences as potential explanations for the racial wealth gap.

-Daniel and Dionissi

Under the hypothetical scenario used in their model, wherein no income gap exists since 1962—meaning all things equal in payscale between blacks and whites—they claim that the wealth gap likely would have mostly been closed by 2007. That’s because their model predicts that by 1977 the labor income gap has become a stronger contributor to the wealth gap than the initial conditions, and then accounts for more than 80 percent of the wealth gap by 1990, as visualized in the chart below.

It can’t be overemphasized that much of the scholarship on the racial wealth gap denies that income is a major factor. Instead, it insists that wealth inheritance and higher education fuel inequality. Less than four years ago, Federal Reserve economists were pointing to homeownership as the primary driver of the wealth gap.

(Comment 7/8) Initially, we were surprised by our main result:

We also expected that homeownership and the intergenerational transfer of wealth would be at least as large of factors in maintaining the wealth gap as income differences.

The role of homeownership is captured in our model by

unequal returns on capital.

This mechanism is suspected as a contributor to the wealth gap because of the history of redlining and the continued segregation of US cities.

The intergenerational transfer of wealth is captured in our model by unequal inheritances.

This mechanism is suspected because the initial wealth gap from 1962 was so large that one might imagine it being self-sustaining even if returns to capital and labor income were the same.

Racial disparities in mortality rates also seemed like they might play an important role in what our model predicted, because these differences are in fact quite large.

After reflection, though, we think it does make sense that unequal labor income matters more than unequal returns on capital and inheritances, even given the tremendously different initial conditions faced by black and white households.

Three reasons are as follows:

First, our results point to a view of ownership of assets like homes and retirement accounts as a way of storing wealth generated by income rather than as a way of making huge returns.

While there certainly are exceptions, this is probably the most accurate general characterization.

Second, the best empirical evidence we have suggests that large intergenerational transfers are simply too rare to be the main driver of the wealth distribution.

Finally, when added up over time, it is not surprising that differences in income drive differences in wealth.

Daniel likes to think of this in terms of an analogy using the speed and position of two cars:

A relatively small difference in speed can lead to a large difference in absolute position if it persists over time.

-Daniel and Dionissi

What can’t be denied is that a wage gap exists, persists, and appears to be worsening. According to the 2018 State of Working America Wages report from the Economic Policy Institute, the wages for white workers grew much faster than wages for black and Hispanic (EPI’s term) workers since the year 2000, and this was true from the lowest- to the highest-earning workers. Other findings from the report:

Valerie Wilson, director of EPI’s Program on Race, Ethnicity, and the Economy, says that while it’s important to close these wage and income gaps, she’s skeptical of how effective that could be in slaying the more racial wealth goliath.

“I don’t imagine a world where you could simply close the income gap and everything else just falls into place,” said Wilson. “Even when we look at dimensions of the wealth gap, such as looking at education levels: If we presume that education is closely tied to job and wages, then we should see narrower wealth gaps. But we don't. In fact, it shows that African Americans with a college degree still have less wealth than white families where the head dropped out of high school. That challenges the idea that if we close the income gap then everything would be equal.”

Several economic policy proposals designed to enhance the incomes of modest earners—some that ostensibly target racial wealth gaps—have picked up considerable support in recent years. There’s the ongoing Fight for $15 campaign to boost minimum wages, as well as universal basic income pilots that provide monthly cash payments to a small number of residents in Stockton, California and Jackson, Mississippi. The Green New Deal also prioritizes jobs and union-level wages for historically underemployed populations—often code for African Americans.

Designs on a federal jobs guarantee are afloat while Senator Cory Booker, a U.S. presidential hopeful, has introduced legislation to create “opportunity accounts”—baby bonds of sorts where newborns would be provided savings accounts seeded with a $1,000 deposit that would grow with interest until they became adults. Senator Elizabeth Warren, also a presidential contender, has introduced a housing bill that would restore those who lost equity in the mortgage crisis and would correct past housing segregation and redlining sins. And there’s the looming specter of reparations, which several presidential contenders have been eager to discuss.

It’s another question whether any of these proposals alone (except maybe reparations) would go far enough to wipe out the huge gains in wealth that whites have claimed over 400 years compared to all of the potential wealth eliminated from African Americans in that time. Anne Price, president of the Insight Center for Community Economic Development (ICCED), has pushed for the opportunity accounts idea that Booker is promoting for years. She says that, combined with Warren’s housing proposal, could go a long way toward putting a dent in the black-white wealth gap, at least at the median level. However, like Wilson, she finds the project of focusing on income gaps alone a dubious prospect.

“People are looking for that silver bullet to say it’s homeownership, it’s income, and then that will be the solution,” says Price. “That’s very misleading and a bit dangerous because it takes us off course from working on a number of solutions that are needed. The way we talk about the racial wealth gap has been very limiting. The issue is not just about how to help people build wealth. We have to also curtail how wealth is extracted in so many ways—we have to look at things like corporate power, mass incarceration, municipal fines and fees, and how they are directed at communities of color.”

(Comment 8/8) We do not interpret our work as implying that there is a "silver bullet" for solving the racial wealth gap. We conclude our Commentary as follows:

-Daniel and DionissiThe key policy implication of our work is that policies designed to speed the closing of the racial wealth gap would do well to focus on closing the racial income gap. Of course, this focus leads to another broad set of questions surrounding the racial income gap. For example, what is the relative importance of factors such as racial discrimination in the labor market (Bertrand and Mullainathan, 2004), incarceration policies (Neal and Rick, 2014), and skills (Neal and Johnson, 1996) in maintaining the racial income gap? Even more broadly, social scientists since Wilson (1997) have focused on the role of factors such as deindustrialization, neighborhoods, and schools in the persistence of the racial income gap. Recent findings that the intergenerational transmission of income is lower for blacks than for their white counterparts at all levels of income (Chetty et al., 2018), and that the same is true for neighborhood quality regardless of wealth (Aliprantis et al., 2018b), suggest that policies successfully addressing the racial labor income and wealth gaps will have to address a broad set of issues.

Last year Price’s ICCED organization partnered with researchers at The Samuel Dubois Cook Center on Social Equity at Duke University to produce the report “What We Get Wrong About Closing the Racial Wealth Gap,” which dispels notions that issues such as the racial homeownership gap is the driver of wealth disparities. It also disabuses ideas that African Americans’ personal responsibilities and choices, or improving their financial literacy and entrepreneurship rates would narrow the wealth gap. Or, that black people can educate and work themselves out of the wealth crisis. The report’s analysis suggests that even if African Americans produced more income through opening businesses and buying properties, and then managed that income more astutely, they still would not reach the wealth levels of whites, chiefly because of deeply entrenched structural racism, and discrimination in the workforce and lending industries. Reads the report:

There are no actions that black Americans can take unilaterally that will have much of an effect on reducing the racial wealth gap. … Addressing racial wealth inequality will require a major redistributive effort or another major public policy intervention to build black American wealth. This could take the form of a direct race-specific initiative like a dramatic reparations program tied to compensation for the legacies of slavery and Jim Crow, and/or an initiative that addresses the perniciousness of wealth inequality for the entire American population, which could disproportionately benefit black Americans due to their exceptionally low levels of wealth.

Price adds that even if only discussing the present-day causes and persistence of the black-white wealth gap, there are still critical factors to consider such as who will be considered white in the future. Race, as defined by the U.S. Census Bureau, has historically been a moving target since its beginnings, and not necessarily to African Americans’ advantage. There are some Latino populations that could end up being categorized as white. The EPI “State of American Wages” report is already showing that the wage gap between whites and Latinos has been narrowing over the last 18 years at a far faster clip than the black-white wage gap.

“Whiteness changes; blackness doesn’t change,” says Price. “So when we have these conversations looking 50 to 100 years from now—race is not static. That’s the problem of looking at this solely as an issue of a gap. We have to look at how power is shifting, how power is concentrated, and how a white identity advantages and how that may change over time. These are the questions we need to be asking and not be fixated on just data points that then become drivers for our energy and our solutions.”